In our post titled How to Compute SSS Pension, a reader asked about the amount of her pension if she will pay the maximum SSS contribution of 1,760 pesos for the next 20 years.

Question from Maritess B:

If I pay the maximum amount of 1,760 pesos for 20 years, how much pension will I get at age 60. I am an OFW. I have paid for 7 years already, but not the maximum contribution.

Can I have a sample computation?

I have paid for 7 years, and then I stopped. Now I want to continue contributing for up to 20 years. So all in all, I will be contributing for 27 years. Isn’t it that you’re computing pension only for 10 years? Can I get back my contributions for the excess years of 17 years as a lump sum?

Answer:

First, I should say that the result of my computation is only an estimate. I am basing my computation only on published SSS guides. So ask SSS for accurate computation.

[adsense]

If the maximum contribution at the time you retire is still 1,760 pesos and if the maximum salary credit is still 16,000 pesos, then we can safely assume that your Average Monthly Salary Credit (AMSC) when you retire will be 16,000 pesos, since you said you’re going to pay the maximum contribution for the next 20 years.

We can also safely assume that your AMSC for the last 60 months prior to your semester of retirement will be 16,000 pesos.

Your excess Credited Number of Years (CNY) will be 17 years, assuming that you correctly counted your previous years of contributions.

We will use Formula No. 2 in the How to Compute SSS Pension article:

300 pesos + 20% of AMSC + (2% of AMSC x Excess CNY)

300 pesos + 20% of 16k + (2% of 16k x 17)

300 + 3200 + (320 x 17) = 8,940

Your monthly SSS pension will be 8,940 pesos.

Regarding your question about whether your contributions for 17 years will be given in lump sum:

Your contributions for your excess number of credited years (17 years) will NOT be given

in lump sum. Your contributions for 17 years will be included in the computation of your pension.

What is that SSS lump sum I keep hearing about?

A lump sum retirement benefit is given to members who retire with less than 120 contributions. It is equal to total contributions plus interest.

The lump sum for new pensioners is like a cash advance. If you’re a new pensioner, you have the option of getting a lump sum, which is actually an advance of your first 18 months of pension. You get your lump sum, but you will get your next pension after 18 months.

Now the next question is: “Is it worth continuing contributing to SSS for the next 20 years?”

Let’s say that you will pay 1,760 pesos for the next 20 years (240 months), so your total contribution will be:

1,760 pesos x 240 monts = 422,400 pesos

Let’s assume that you paid a total of 84,000 pesos for the 7 previous years that you mentioned:

1,000 pesos x 12 months x 7 years = 84,000 pesos

The total of all the contributions you paid to SSS over 27 years is 506,400 pesos.

422,400 + 84,000 = 506,400 pesos

Is paying a total of 506,400 pesos worth it?

At what age will you be able to get back your 506,400 pesos?

Assuming you will get a monthly pension of 8,940 pesos starting at age 60,

you will be able to recoup your payment of 506,400 pesos at around age 65.

Pension paid in 1 year = 8,940 x 12 = 107,280

506,400 / 107,280 = 4.72 years (4 years and 9 months)

If you will live until age 85, then you would have earned more than 2 million

pesos as total interest of the money you paid to SSS.

8,940 x 12 months x 20 years = 2,145,600 pesos

There are also other SSS benefits like salary loans, maternity benefit, sickness benefit, disability benefit and funeral benefit.

There is also an educational loan program, although it’s out of funds right now, and a housing loan program, although the Pag-ibig housing loan program is more popular and more accessible.

How about if you will not live long to enjoy your pension for many years?

If you pass on to eternity while a pensioner and you have primary beneficiaries (your spouse and children younger than 21), your primary beneficiaries will receive your monthly pension.

If you do not have primary beneficiaries, and you pass away within the first 60 months of your pension period, your secondary beneficiaries will receive a lump sum, which is equal to the balance of your pensions for 60 months (60 minus number of months already paid for x monthly pension).

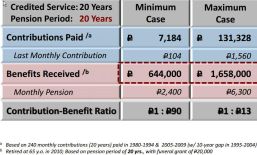

Here’s a computation made by SSS, part of its publication The Value of SSS Membership.

Hi Noel, no, your AMSC won’t change if you stop after your 120th contribution. It’s best if you continue contributing to SSS while working abroad (maximum contribution within the last 5 years) so your pension amount will increase. You can now see your projected pension amount on your online SSS account. If you have not enrolled yet, this is how to enroll in online SSS. There are 2 amounts you can see: Projected pension amount via Simulated calculator and pension amount as of current date via Inquiry. The first one, you select E-Services, then click Simulated Retirement Calculator. The second one, you select E-Services, then click Inquiry, then Eligibility, then Retirement – Pension, then enter your retirement date.

Hello Ms. Nora,

I am an OFW and by the age of 56 I will complete the 120 months max. contribution, at that time can I stop paying SSS contribution even if I am still working abroad?

Is the AMSC will change if I reach the age of 60 without my 4 year contribution prior to retirement?

Hi Richard, yang 60-month count na yan ay nagagamit lang kapag ang pensioner ay namatay habang nagpe-pension, at wala pang 60 months na nagpe-pension at wala na siyang spouse or children under 21.

Pero kung ang isang member na hindi pa nagpe-pension ay namatay, ang makukuha ng spouse o kids under 21 ay monthly pension. Kapag walang spouse o minor kids, yong mga adult kids will get a lump sum, which is equal to 36 times the monthly pension.

Nagbabalik ng contributions ang SSS sa isang condition lang: kung ang member ay mag-claim at age 60 o older, at kulang siya sa 120 contributions.

Good day

For a member who passed away… sabi nyo the beneficiaries will just receive 60 months of pension minus from the pension received by the member…

so if the member has paid 200+ plus contributions di na mababalik unh contribution nya sa family nya? In excess po dun sa 60 months na bibigay ng SSS?

Thank you

I am a voluntary/OFW SSS member, paying monthly the maximum amount of PHP 1760.00. Now I think that I will ONLY use my SSS for pension, since I have other insurance to cover illness for example. And this made me think if paying the maximum will still be worth it. I have read a lot of articles – and I will agree to them – that if you are ONLY concerned for the pension benefits, you could pay small amounts and just jack up the contribution as you hit 54 y/o. This is because the pension calculation only considers the amount during years you paid from 55-60 y/o. Even if you dont pay the max contribution until you are 54 y/o, you will still get the same pension benefits with the person who paid maximum all through his/her life. The major difference is just the other benefits of SSS, ie salary loans, which I have mentioned is really not my priority for SSS.

Hello Mam/Sir,

Bale hindi na po bago sa inyo concern ko, katulad lang po ako ng iba na hindi nababayaran ang SSS ng Employer ko and di ko alam if pati PhiliHealth at PagIbig.Ask ko lang ano po ba ang dapat at di dapat na gawin. Need ba na ireport sa SSS or kausapin ko employer ko, para bayaran? Feb 19 start date ko sa company up to now, pero lumalabas sa record na Last Date posted is April 2017(my last month from previous employment). Thank you for the Help.

Hi Pauline, kung employed ka, hindi puedeng ma-stop ang SSS contributions mo kasi mandated ang employer to collect and remit contributions. At sayang din yong share na ibibigay ng employer mo, additional benefit yon. Mas malaki ang pension ng nag-contribute ng more than 10 years kesa sa nag-contribute ng 10 years lang, except lang kung ang i-compare mo ay yong mga members na paying the lowest amounts like 36.30 or 110 pesos per month (merong minimum pension: 1k na ngayon ay 2k pesos na due to Duterte’s order).

Look at this main formula in computing SSS pension: 300 + 20% of the average monthly salary credit + 2% of the average monthly salary credit for each credited year of service (CYS) in excess of ten years. Merong dagdag (2% of the average monthly salary credit x extra years) kapag more than 10 years kang nag-contribute.

Hi Ms. Nora, I just want to clarification lang po about atleast have a contribution for 120 months or 10 years.

I Started working dated 2008 and until now 2018. And na mention po ata dun na if nagcontribute ka more than 10 years for example 15 years. Ndi mo makukuha ung nacontribute mo for 5 years? Correct me if I’m wrong po. Pwede ko po ba ipastop ung paghulog sa sss? Ano pros or cons po if magstop ako magbayad sa sss after 10 years?

cartierbraceletlove “And it was the Roe decision, the Casey decision and subsequent decisions on abortion that have led us to this decision on marriage,” he said. “It’s a fundamental rewriting of the Constitution, ignoring truth, ignoring Nature and Nature’s Law.”

falso cartier anello oro rosa http://www.gioiellibuonmercato.org/

Skype has launched its website-structured customer beta on the world, following launching it generally

from the Usa and U.K. previous this four weeks. Skype for Website also

now can handle Chromebook and Linux for immediate messaging communication (no voice and video nevertheless, these need a plug-in set

up).

The expansion of your beta adds assistance for an extended selection of languages

to assist reinforce that global user friendliness

I possess just about everything I am able to think about and that i additionally had a couple various other professionals give it a go. anything should go great unless you attempt to put in a suppose OS IN THIS HANDSET. Exclusively for switches i actually even attempted adding a guest apache. There are quit currently and that i in the morning at the moment with an iSCSI targe program through KernSafe. this can be a first time I possess experimented with iStorage from Kernsafe… remorseful, i don’t imply to mention fall, I have not any interest in all of them. On the Bright be aware I saw a thread someplace having said that that they had the actual VM your five. a, Microsof company iSCSI difficulty in order that they tried out the MICROSOF COMPANY Web server main Programmer copy featuring a iSCSI focus on program also it function excellent, yet that does not assist me to at the moment inside production.

Hello magtatanong lang po ako..kong my 10 years na akong nghuhulog ng sss pwede na ba akong huminto na magbayad at hintay ko nlng na mag pension ako..im 53 next year..

hi mam may follow up question lang po ako. kung matapos ko po yung 120monthly contribution sa sss at the age of 45 yrs old at maximum po ang contribution ko pde na po ako huminto mag bayad and may pension na po ba ako when i reach 60yrs old? salamat po

Hi Joanne, if you’re employed, you will continue to pay your SSS as long as you’re employed, until age 65. But if not employed, and you already have accumulated 120 contributions (the minimum no. of contributions to qualify for pension), you can stop if you like. But remember that your pension computation is based on the overall no. of years you contributed and the average of your last 60 monthly salary credits prior to your semester of retirement. This means it’s wise if your last 60 monthly contributions are maximum.

Hi. i started paying sss contributions since 1997. My question is until when do i need to pay my monthly contribution? Thanks.

Hi charlene, sorry no, that’s not true. Your pension will depend only on 2 things: the total no. of years that you will contribute and on the average of your last 60 monthly salary credits prior to your semester of retirement.

Of course if more members borrow from SSS and pay faithfully, more interests will be added to the profits of SSS as a whole institution. Interests will not be added to individual accounts. This is how SSS pension is computed.

Good day Ms Nora, I kept on hearing from everyone that it is better to always make use of the SSS Salary loan so that your savings will have a higher return when you retire. Is this true that the interest you paid from paying your loans will be added to your contribution?

Thank u for info.. yup i have 6 mos. And still ongoing..

Hi Aris, it means you need to present your birth certificate, either from NSO or from your local civil registrar (original and xerox copy), at an SSS branch. Bring your ID. Maybe when you applied for your SSS no., you presented only a xerox copy or your presented a secondary document. By the way, another loan requirement is you should have at least 6 contributions within the last 12 months or prior to application.

Thanks it helps a lot.. its all posted but when i check to apply loan online it says that my ss number was temporary tagged .. i need to submit req. .. what is that?

Hi Aris, yes, your contributions need not be continuous. You can have gaps. There can be months when you did not have payments as long as your total no. of monthly contributions is 36 or more. Make sure all the 36 are already posted before applying. Most employers submit their collection list (where employee names are written) the month following the quarter (deadline depending on their SSS no.).

Hi nora if I apply for an sss loan, does the 36-mo. requirement need to be continuous? or gaps are allowed? like you have jan to june contributions then you don’t have payment for july then you start again in aug. Until you accumulate 36 mos. is that ok?

Hi Ronald, SSS has not yet launched its online application for PESO. As of now, applicants are required to apply in person at any of 10 SSS branches where the PESO is being piloted. Are you already a member of SSS Flexi-Fund? This is the savings program exclusively offered to OFWs.

Hello, how can we apply for the P.E.S.O Fund Program of SSS? Do they have application thru online? Im an OFW here working in Uzbekistan. thanks

Hi gilmore, will you be retiring within 5 years? If yes, send me the amounts of your monthly contributions last year and this year, and also the no. of years you have contributed to SSS, and I will give you an estimate. I have examples here: https://www.workingpinoy.com/2014/01/how-to-compute-sss-pension/

hello po. can you compute my sss as of now. I’m not yet retired but from the contributions, amount can be computed. i can send you and attachment in pdf my contributions table.

Am scheduled to retire from sss by Jan 7, 1956 and has remitted 353 monthly contributions. my last contribution is php1,760. How much is the approx. lump sum that I may get? thanks

My mother passed away and as we remembered we are the beneficiaries (siblings)of my mom,but then my grandmother who’s 83 caring by my auntie get the funeral benefit of my mother etc from SSS,which i think is not correct although my dad also passed away we(siblings)are only beneficiaries of my mother,according to sss rules if the mother/father still alive she/he can get the claim…Just asking question if sss has a rule of that…I think it is not good…

Hi Bartolome, you can email ofw.relations@sss.gov.ph (technically you’re not OFW, but you’ll get quicker response here) or member_relations@sss.gov.ph (Subject: Attention: International Operations) and ask for an electronic copy of your contributions. Or you can register online so you can see your records from the year 1990. For contributions prior to 1990, SSS will make a manual verification of hard-copy records when they’ll compute your pension. To register online, you need a transaction no. from your more recent contribution payment. You can increase your pension if you’re making higher payments these last months, but you need also to consider the rules in increasing your contributions. The rules are in the lower portion of this SSS RS5 form.

Hi Nora, I’m retiring next year August, that month is my 60th years of age, and off course I’m calculating my pension would be.

My questions is, how do i know the total amount and total months of my contributions, I was a member of SSS since 1975, but I dont know if all the company that i work are remitting my deductions. Thank You,

Hi Ms.Nors magtatanung po ako tungkol sa flexi fund halimbawa po maghuhulog ako ng maximum tapos add ako for fund kailangan pa po ba yan ng application or deretso nko sa remitance to pay the contribution and fund kc po d2 ako sa qatar wala din time pumunta sa owwa..Sana po pag nagcollege na ang anak ko may chance din akong magloan for educational plan pero matagal pa un sa ngaun ill try to pay the contibution and fund..ang fund po halimbawa nakaipon ka ng 100k tapos gusto mo kunin ung 50k ok lng po un or you need to wait for the maturity date nya..thanks po

Thank you Ms. Nors…