NOTICE to ALL DANVIL Planholders:

The DEADLINE for FILING YOUR CLAIMS was JULY 30, 2015.

If you were not able to file before this deadline because you did not know there was a deadline, you can still file, as long as your name is in the Danvil masterlist. Sorry I don’t have a copy of this masterlist. The wisest thing to do is to file as soon as you’ve read this.

Info for filing is here: Notice from Danvil Plans

————————————————————————————-

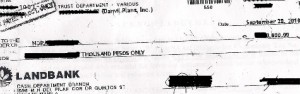

This is a scan of the check I received from Danvil Plans last October, which cleared on third day after deposit. Danvil paid my benefits according to the contract, at the promised amount, on the promised date.

Why am I posting it?

First, because I want to share some rays of sunshine to my fellow Danvil planholders who are still to claim their maturity benefits. According to the PhilPrudentialife Insurance (PPLIC) officer who handed me my check (PPLIC has been processing Danvil’s claims as part of an agreement), the last maturity dates of Danvil plans will be in 2013 — those pre-need plans issued under the Berkley/Family Life partnership, later purchased by Danvil Plans.

I took his explanation to mean that those plans sold by Danvil and which are maturing after 2013 are PPLIC plans, which are insurance plans, since PPLIC is an insurance company. (By the way, PPLIC has launched its new website. Type in danvil.com.ph and you’ll arrive at PPLIC’s website.)

Secondly, I posted the check to show that pre-need firms can fulfill their promises to their planholders if only they manage their firms well. All the pre-need firms in the Philippines suffered through the same global financial meltdown, but Danvil and the others have been able to survive. Why did the others collapse? Because they touched their trust funds, they invested in unsaleable memorial-lot and other real estate projects and they went overboard in their administrative expenses.

Sabi ng ibang pre-need firms, kasi global financial crisis, kasi bumaba ang interest rate, kasi… Bakit? Kung bumaba ba yong interest rate, bumababa rin ba yong principal? Kung di ninyo gagalawin yong trust funds, andon pa rin sila, makakapag-antay sila ng time na tataas uli yong interest rate. Hindi naman sila stocks.

Sabihin ng ibang pre-need firms, hindi ganong kasimple… Ganon? Ang mga simpleng tao na nagpakahirap para lang makaipon para may pambayad sa premiums (at hindi naman sana sila nagpakahirap na magbayad sa inyo kung hindi ninyo sila binola, in the first place), ano na sila ngayon? Yong iba nga, umaasa na sana makuha nila yong claims nila at pambili na lang ng gamot, o kaya pangtawid sa araw-araw kasi nawalan sila ng trabaho.

These past weeks, it’s been painful to read comments from Ideal Pension planholders as they ask me about how to pursue their claims. They live in Mindanao, in the Mountain Province, in the Visayas — how can they travel to Makati and attend the bankruptcy/insolvency hearing for Ideal Pension? At para saan ang hearing na yan? Paano na yong mga walang pamasahe at time para mag-submit ng claims? Yong mga walang lawyers? Sino ang tutulong sa kanila? At bakit bankruptcy?

That’s why I’m glad that it’s not Ideal Pension people that made bola to me years before, or the other failed pre-need firms, but Berkley/Family First/Danvil Plans. At least, kahit overboard yong marketing nila noon, they fulfilled naman their promise to me, giving me the exact amount of maturity benefits promised, on the date promised. Danvil has been paying benefits since the first plans matured in 2008.

[adsense]

To Mr. Daniel Villanueva of Danvil Plans and the other Danvil officers, although it’s your legal duty to pay our maturity benefits, and therefore there’s no need for thanks, in light of what happened in the pre-need industry, I thank you for:

1. listening to advice and didn’t pursue the almost-done sale of Danvil Plans’ pre-need portfolio to Legacy.

2. not touching the trust funds and not putting our money in uncertain investments (presumably, kasi natanggap naman namin ang mga checks namin at nag-clear.)

Businesspeople with INTEGRITY and MORAL VALUES, sana dadami pa kayo.

Related articles:

Danvil Plans — Claiming Your Maturity Benefits

Pre-need Companies in the Philippines Now under Insurance Commission

This paragraph is truly a nice one it helps new web viewers,

who are wishing for blogging.

Hi Ruben, yes, if you have the required documents. You can use LBC to send your documents. Send photocopies. See info here: Danvil Plans

hi I have insurance can I still claim it I live in Canada

Hi edith, I hope you’ve already gone to Atty Togonon’s office along Quezon Ave. Deadline is July 31, 2015. Here is the advisory: https://www.workingpinoy.com/pre-need/danvil-plans/

I have my maturity plan since 2008 and its is only now that i will be filing my claims seeing what had happened also to my other insurance plans. I tried to locate the Family First /Berkley plan , which became Danvil, and sought to inquire how i can get my claim , which turn out in vain. . Finally, I am hopeful I can get my maturity claim,and will go to your office tomorrow. Hope I can get this claim once and for all. I gt encourgaed with some of the posted comment herein.

Hi Senen, call or email the phone nos. here: https://www.workingpinoy.com/danvil-plans/

ask ko lang po. naka full payment na po ako this July 2013. paano po marereceive yung Certificate of Full Payment or paano kukuhanin?

Hi Rosalinda, https://www.workingpinoy.com/danvil-plans/

hi!im rosalinda pineda im requesting you to back on active my plan thank you”