Last Monday, February 15, I became free from the bondage of credit cards. And I pray I’ll never become a slave again.

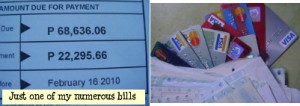

Amid the pain of selling something meaningful to us, my husband and I sold the lot we bought in the 1990s just so I can be free. Over the past few years I became a slave to lenders, as I accumulated more than 200,000 pesos in credit card debts.

Even with a higher-than-average salary, I couldn’t make a dent on the principal balances even if all my payroll money goes to paying the monthly card bills. I had to work overtime everyday, even on Sundays. I couldn’t even visit my aging parents in the province because there’s nothing to set aside for fares.

There’d been a lot of pain… and other awful things too embarrassing to describe here. It’s enough that now I’m free.

(by bluesemotion, photobucket)

And I thank God that amid my many grave financial mistakes, there’s one good investment that I did when I was younger — that is to buy a lot in a good location and pay the amortization faithfully through the years no matter how hard. And now, it was the one that saved me.

Credit cards are not evil per se. They can help. They have helped me when people I love had to be hospitalized and when tuition needed to be paid.

BUT credit cards are like knives — they can kill if not handled carefully.

There are many important things I have to tell my children. But there’s one thing they don’t have to hear about — the consequences of credit card use. They’ve seen how I suffered and almost got drowned in torment.

Credit cards in the Philippines

SA LAHAT PO NG IYAN ANG MAY KASALANAN ANG BSP, ANG DEPT OF FINANCE, ANG BANKERS ASSOCIATION OF THE PHIL, AND THE GOVERNMENT. THERES NO RULE SILANG BINIGAY KUNG ILANG CARD ANG PWEDE SA ISANG TAO. ANG SAHOD P15,000 MAY SAMPUNG CREDIT CARD ANG PINAKAMABABA P20,000. SA P2,000 NALANG NAUTANG EACH CARD P20,000 NA SAN NYA KUKUHANIN PA ANG PAMBAYAD DYAN.DIBA?

DAPAT PO SA UNANG CREDIT CARD PALANG NA NAKA RECIEVE ANG CLIENT IPADALA NA NG BANK ANG NAME NG CLIENT AT ANG INFO NITO SA CMAP AT SA BAP PARA KUNG MAG AAPPLY PA SYA NG IBANG CARD SA IBANG BANKO PWEDE NA KAAGAD MAG TANONG SI BANKO KAY CMAP/BAP KUNG KAYA PA BA NG PAYING CAPACITY NITO TAONG ITO KUNG MAGBIBIGAY PA KAMI NG ISANG CARD SA KANYA . HINDI ANG GINAGAWA NG INUTIL NA CMAP AT BAP KINUKUHA NILA INFO NG TAO PAG HINDI NA MAKABAYAD PARA DI NA MAKAUTANG PANG MULI. ALREADY LATE BANKERS ASSOCIATION OF THE PHILIPPINES AT CREDIT MANAGEMENT ASSOCIATION OF THE PHILIPPINES PINABAYAAN MO NG MALUBOG ANG TAO SAKA MO SYA NA I BLOCKED, WITH THIS KAYO PO ANG MAY KASALANAN

I have a fiancee who had a similar issue with credit cards and you are right there that it is like a knife that can cut anything especially you and that is why care is needed. She was constantly harassed and had trouble talking MB to make arrangements and had decided to let them do whatever it is they would do to her credit. Thank God we found moneydoctors a local true financial planning firm that are sort of like a school for the financial educated. This comp is unlike any other “financial planning firm” that pretends to help u plan but in truth are trying to sell you more things than help u get out of debt. A lot of filipinos are educated in many things but handling finances and unfortunate for us we get burnt before we learn. Thanks for the article. It was kinda lacking at the end though but a good read.

Hi rayman, thank you very much for sharing your story. It’s good you were able to pay the cards and it’s good you were able to get one from PNB. Others can re-start with a secured credit card from RCBC Bankard. Yes, 12 major banks are members of the Credit Card Association of the Phil. Thanks again. I’m happy that you’ve learned your lesson well. Others will learn from your story.

I just want to share my experience about credit cards. 2 years ago i was stuck with 6 credit cards. Back then it was manageable because my overtime is sufficient to pay for the minimum balance. But then when I was promoted with minimal increase and the O.T’s were no longer there. The overlimit fees, charges and late payments started to piled up. There was no way of paying if off 1 by 1 so I said to myself I won’t be paying any of it. Bahala na. But soon after the calls from the collection agents were non-stop they started calling you from everywhere. They even threatened me that if I didn’t pay up then I’d be thrown into prison (obviously I know they can’t) but then I realized that I would have problem in the future if I decided to get some kind of loan in the future. To cut the story short. I inquired about their amnesty for delinquent card holders and requested if the charges could be removed and I’ll pay with a fixed amount for 12 months most of them agreed while some offered a 1-time payment just to close the account. Earlier this year I was having trouble getting 1 because of my credit card history. I think they can track people that has credit history. Good thing I kept all of my certification from all the previous credit cards I paid and submitted it to PNB. Atleast, now I know how to manage a credit card… I won’t make the same mistake as before.